German companies have been feeling the effects of the pandemic for months: demand is falling, supply chains are breaking and some companies have had to announce short-time work. But there are also economic beneficiaries of the crisis. An overview of the winners and losers of the pandemic and what you should keep an eye on now.

The Corona pandemic has been the dominant topic for more than a year: The far-reaching limitation of public life is showing clear side effects on the global economy and is causing great uncertainty in the market in some cases. The export-oriented German mechanical and plant engineering industry is also affected by the consequences of the pandemic.

But how worshipful are the effects really? How do companies assess the situation in the industry and what measures are and should be taken? In numerous conversations with our clients, we hear both positive and negative things. Therefore, we took a closer look at the assessment of associations and industry experts.

Measures: How the mechanical engineering sector reacts in the crisis

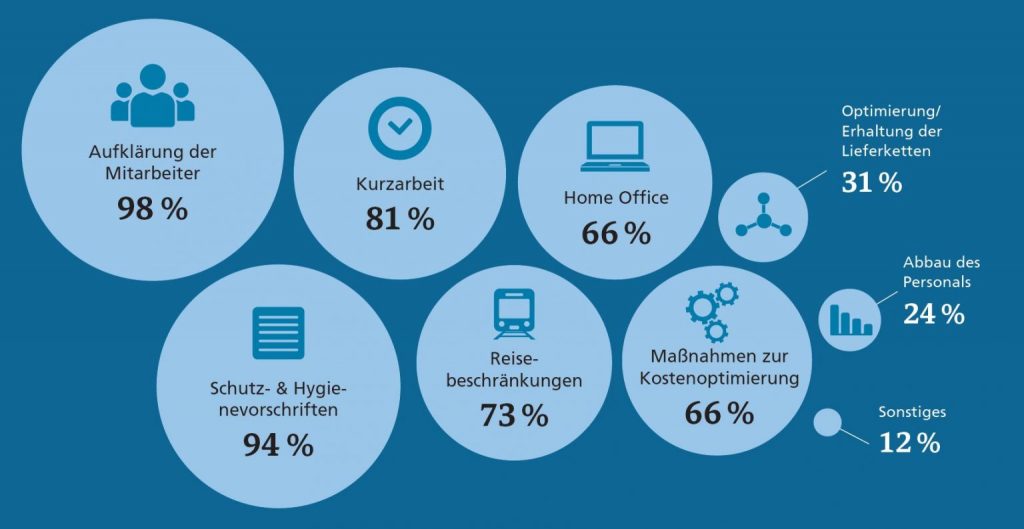

In order to maintain ongoing business, counteract disruptions in the supply chain and support an improvement in the order situation, various measures were initiated during the pandemic. The figure, based on a recent VDMA survey, shows a compilation of the most frequently mentioned measures. According to the chart, almost all companies implemented employee education as well as measures regarding protection and hygiene regulations. At 73 % of the companies, travel restrictions have been ordered and, where possible, home offices have been introduced. 81 % of the companies surveyed have announced short-time work. In addition to these ad-hoc measures, 66% of the companies have introduced active measures to sustainably reduce the cost structure. The different studies also show that 24 % of the companies in the mechanical and plant engineering sector are pursuing a path of active staff reduction.1

The winners and losers

According to McKinsey, only a few companies expect the situation to improve significantly in the coming months. In particular, the German mechanical and plant engineering sector, along with the automotive and electrical sectors, will have to reckon with the greatest slumps in sales.2 Thus, more than half of the mechanical engineering companies expect a drop in sales of 10 % to 30 %. In the long term, there are also other obstacles to growth in the industry. In addition to the influences of the Corona crisis, political factors and the uncertain development in the core markets, the mechanical and plant engineering industry assesses above all the increasing cost pressure and growing competition as the greatest challenge in the post-Corona era.3 In the short term, the industry thus does not see a recovery, but expects a return to the turnover level of 2019 only in the course of 2022.

Outlook: Seize opportunities and emerge as winners from the crisis

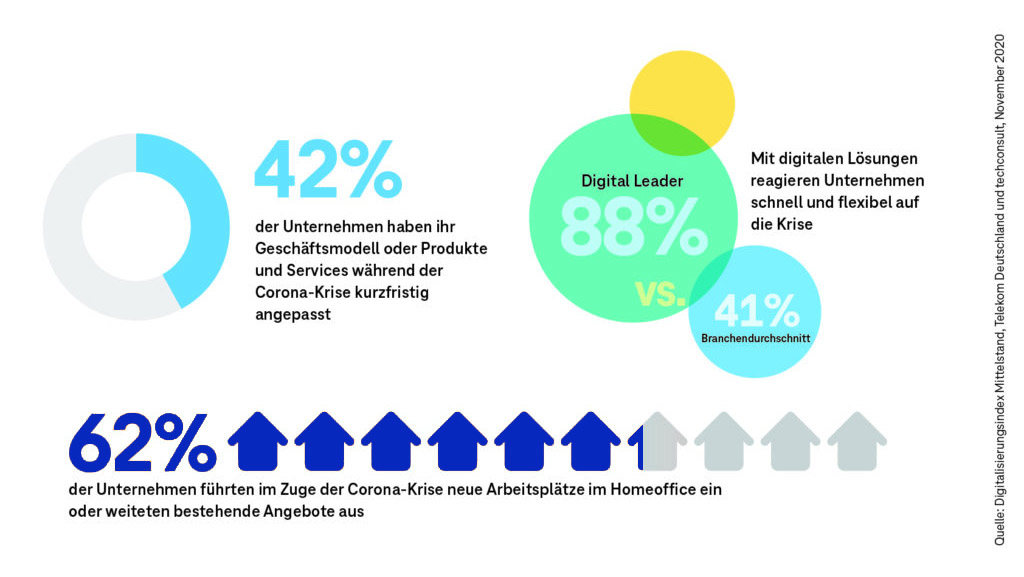

Beyond the negative forecasts, many companies have seen the crisis as an opportunity and used the situation to realign themselves. Short summary of the chart below as a core statement.

In particular, the service business of the mechanical and plant engineering sector had to be restructured during the crisis. This is because despite home office regulations, short-time work and travel restrictions, customers still have to be offered a fast and highly qualified service in order to avoid expensive production downtimes. Customers therefore rely on being helped promptly and having their problems solved as quickly as possible. Where breakdowns quickly result in high costs and serious delays, operators particularly appreciate it when machinery and plant manufacturers continue to provide first-class service.

Numerous companies have already positioned themselves digitally, especially in customer support. Solutions for remote service for customers and remote monitoring of devices, machines and systems from any location and at any time are particularly in focus. Almost every third company already uses such technologies.4 Within the next year, more than half of the companies (58 percent) will be able to benefit from the use of these technologies. Of the companies that already use such technologies, 82 percent speak of better insight into machines and processes, 81 percent of an increase in productivity and 79 percent of a reduction in downtime.5

Our conclusion

From the discussions with our customers, we are gaining a similar picture of the mood as in the VDMA or also among the industry experts. Some sectors seem to be suffering greatly from the effects of the pandemic, especially due to the collapse of supply chains or the lack of skilled workers. In some sectors, including pharmaceuticals or the construction sector, negative effects are hardly present and business is developing almost under normal conditions. What we can clearly perceive, however, is that digital services are strongly on the rise. We see that companies that are digitally well positioned have come through the pandemic much better and have established a good competitive position. Digital solutions are more important than ever, which makes us all the more pleased to continue being a partner to the industry.

Sources:

1 VDMA – Blitzumfrage zum Coronavirus

2 McKinsey Studie – How the German Mittelstand is mastering the COVID-19 crisis

3 PwC – Maschinenbau Barometer

4 Telekom Deutschland und techconsult – Digitalisierungsindex 2020: So haben Unternehmen auf die Krise reagiert

5 Telekom Deutschland und techconsult – Digitalisierungsindex 2020: So haben Unternehmen auf die Krise reagiert